|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

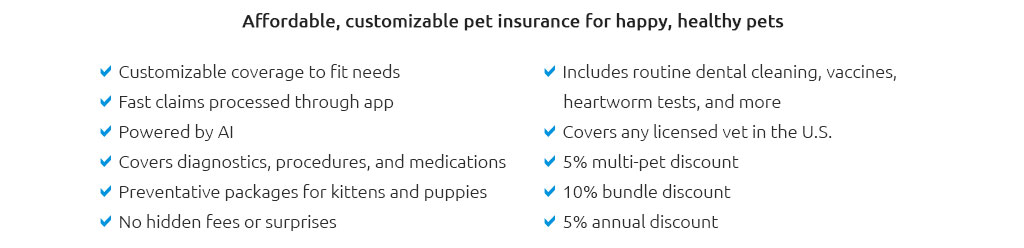

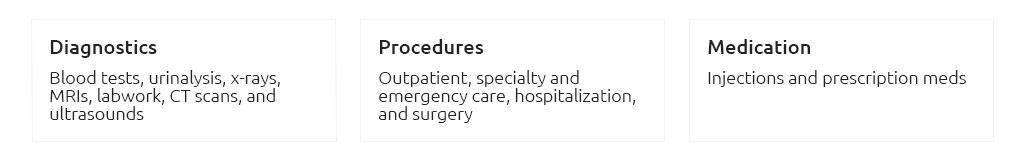

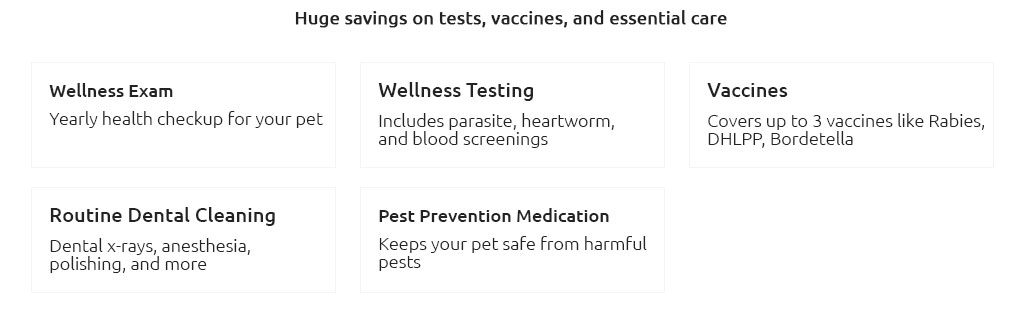

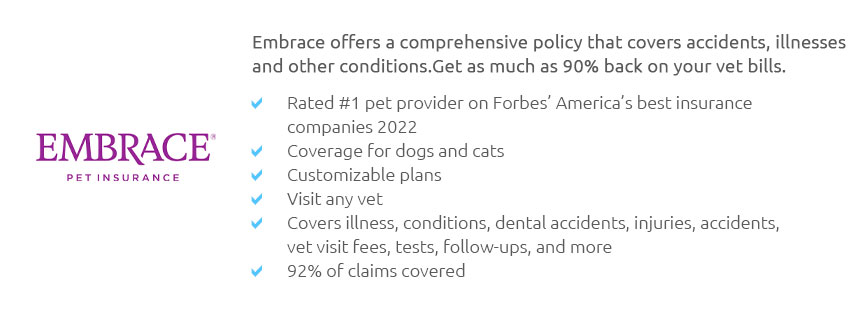

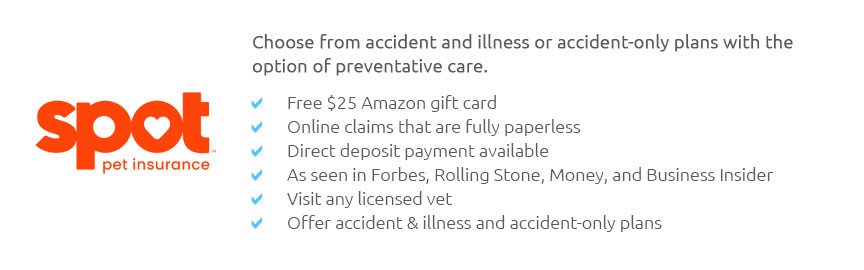

dogs medical insurance: a practical look for careful dog ownersWhy people consider itVet bills jump. Not always, but often enough to make you uneasy. I like my dog and my savings, so I ask hard questions: will a plan actually pay when it matters, and how predictable will my costs be over a year? What policies tend to cover

Usual exclusions: pre-existing conditions, breeding costs, cosmetic procedures, and sometimes dental disease (accidents may be different). How the money mechanics work

Quick reality checkIf your dog already has a diagnosed issue, it likely won't be covered with a new policy. Wellness add-ons can be convenient but aren't always good value if you're disciplined with savings. And for very old dogs, premiums can feel heavy; sometimes a rainy-day fund does the same job with fewer strings. A small real-world momentMy skepticism met a test when my terrier needed knee surgery after a wild park sprint. I paid the clinic, snapped a photo of the itemized invoice in the parking lot, and submitted the claim on my phone. Eighty percent came back nine days later. Not magical, just practical - and yes, I checked the math. How to evaluate without wasting a weekend

Who might reasonably skip itIf you have a solid emergency fund, a lower-risk breed, and you're comfortable self-insuring, a policy may add complexity without clear benefit. Some owners pair a high-deductible plan with savings to keep premiums sane; others bank the whole amount and accept the risk. Usability tips once you're covered

Common gotchas decoded

The bottom lineI don't buy hype; I buy clarity. Dogs medical insurance can turn a scary, four-figure surprise into a planned cost spread over the year. It's not perfect, and it isn't for everyone, but with the right deductible, clear exclusions, and a plan you can actually use, it's a workable tool - not a gamble.

|